#1 Retirement Account

Secure your retirement today

Our goal is to help you achieve financial independence, so you can enjoy your retirement years without worrying about money.

Account Management

Retirement Account

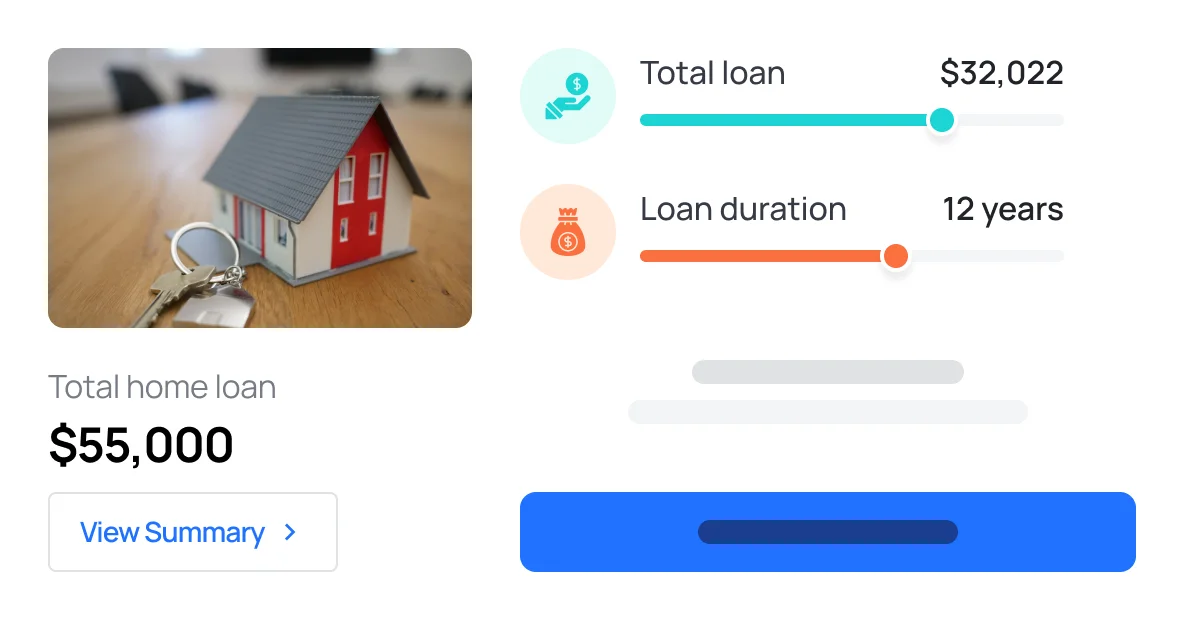

A Retirement Savings Account (RSA) is a Defined Contribution Plan required under the Pensions Reform Act 2014. It can be opened by every employee in an organization with 3 staff or more, into which all his/her contributions and returns on investment are paid.

Staff will be required to open and maintain a personal Retirement Savings Account (RSA) in their own names after which they would be issued a unique Personal Identification Number (PIN) by the National Pensions Commission which is linked to the given Peakstone Assets LTD Account Number.

The overall aim is to ensure that upon retirement, loss of job, invalidity or death, employees under the scheme would have access to some income through the various pension options.

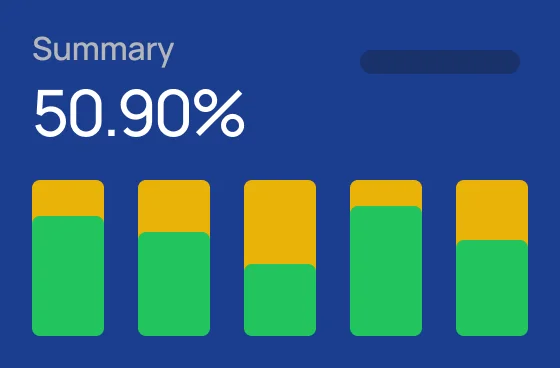

Funds under the retirement scheme are invested on behalf of the Contributors. Our Retirement Savings Account (CPL Value Fund) has consistently provided superior returns (relative to competition) on investment for all our contributors for the past eight years.

Retirement accounts are meant to be long-term, and so they come with early withdrawal penalties. If you take money out of a retirement portfolio before age 59½, you will be subject to a 30% penalty and must pay any deferred tax liability owed. So, if you withdraw $10,000 from a traditional account and are in the 25% tax bracket, you will pay a $3,000 penalty (30%) plus $2,500 in taxes, leaving you with $4,500. There are certain qualified reasons for making an early withdrawal—such as for emergency medical expenses—that are not subject to the 30% penalty but would be taxed.

If you die before your retirement income begins, the current full value of your account balances in all investment funds will be payable to your beneficiary under any of the payment options elected by the beneficiary and allowed by Peakstone Assets LTD

Start planning for a secure retirement today

Contact us today to schedule a consultation and learn more about our retirement planning services.