Over 787 deals funded. $4.3 billion invested.

There is a reason Investopedia has named us Best Overall Real Estate investment platform three years in a row.

As reported by Investopedia, on 12/31/22, 12/31/21 and 12/31/20 based on a variety of factors.

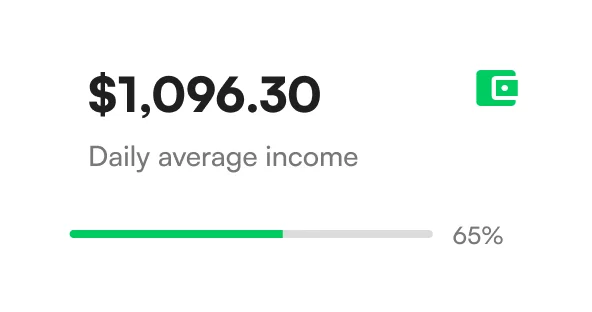

With 177 confirmed realized deals, here are the quarterly results.

Since 2014, Peakstone Assets LTD investors have successfully funded 787 deals, 177 of which have realized (sold). As more deals work through their holding periods, these numbers will be updated quarterly to reflect the latest metrics, which are calculated to be net of fees. Last update 02.07.2024

16.7% Realized IRR

IRR is calculated for individual realized deals based on the aggregate investor cash flows utilizing the XIRR function in Microsoft Excel and with reference to the effective capital contribution dates of each individual investor and the distribution dates by the Sponsor (Issuer).

3.1 Year Hold Period

The hold period is defined as the time between when the underlying property is acquired and when that property is sold and the proceeds are distributed to investors. Typically, Sponsors generally target a hold period of 3-5 years although some deals may target as long as 10 years.

Past performance is not indicative of future results. • Distributions are not guaranteed. • Investment plans on the platformare provided by either Peakstone Assets LTD or Peakstone Assets LTD Capital, a registered broker-dealer affiliate of Peakstone Assets LTD. For more information on who provided the deal please see the overall track record.

Browse Available Commercial Real Estate Investment Opportunities

Compare and review commercial real estate projects from coast to coast to build your investment portfolio. Every deal kicks-off with a live webinar where you can get your questions answered directly by the project sponsors.

Specific risks associated with each individual offering can be found on the offering’s detail page.

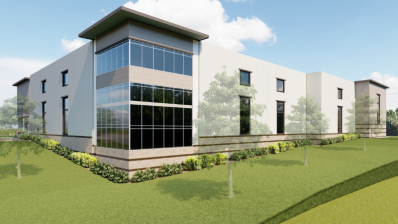

Recapitalization and lease-up of a recently developed, two building industrial park sitting just a half mile from a key national transit corridor in one of the fastest-growing industrial submarkets of the thriving, 95.7%-occupied Nashville metro.

INDUSTRIAL, VALUE-ADDED

Led by an experienced, Boston-based, 10x repeat Marketplace sponsor, a Fund that offers investors participation in any potential GP promote, while targeting a range of investment strategies and property types within the Greater Boston Area

FUND

Diversified debt fund with ~$95M in active loans, delivering high-yield secured senior debt with avg. interest rate of 11.76% (as of Nov '23), that has a 5-year track record of quarterly distributions, in quarter 23 to run down through quarter 24.

FUND

Launched 787 Deals From 343 Project Sponsors Across 17 Property Types In 45 Countries

Investing in commercial real estate entails substantive risk. You should not invest unless you can sustain the risk of loss of capital, including the risk of total loss of capital. Private placements are illiquid investments and are intended for investors who do not need a liquid investment.