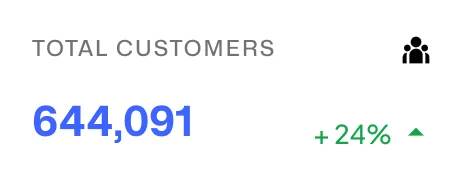

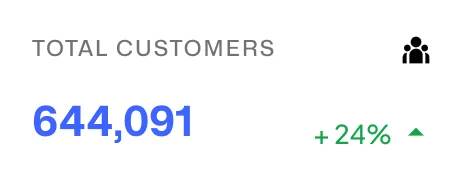

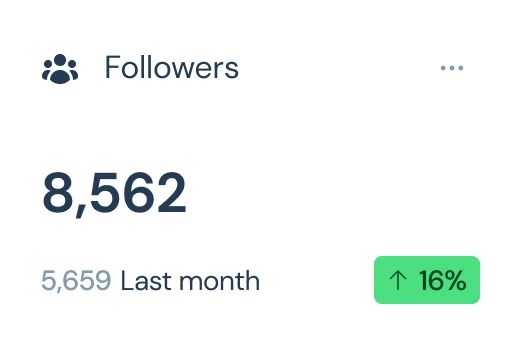

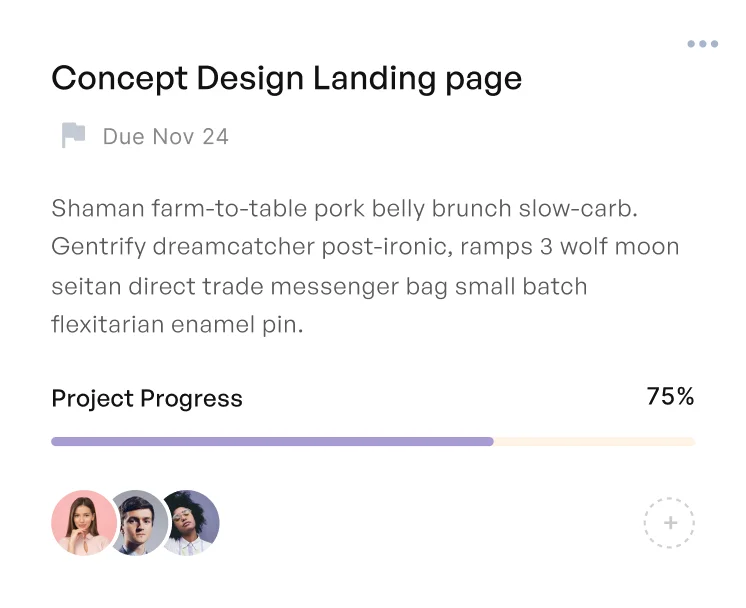

Maintain Progress with Real Time Reporting

Achieve targets, monitor trades, and allocate resources with increased earnings through our robust trading facilities.

Stocks Market.

A stock is a financial instrument that represents ownership in a company or corporation and represents a proportionate claim on its assets (what it owns) and earnings (what it generates in profits).

Stock trading is the buying and selling of a company’s shares with an aim to make a profit. When you buy shares in a company you own a small part of that company, and the value of your investment will change as the company’s share price moves up and down.

It is important to assess your tolerance for risk before deciding how to invest in stocks and if you need help with your investments, be sure to consult your assets manager online.

Financial Market

Forex Market

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism.

The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies, because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world.

Currencies trade against each other as exchange rate pairs. For example, EUR/USD is a currency pair for trading euro against the US dollar.

It is important to assess your tolerance for risk before deciding how to invest in stocks and if you need help with your investments, be sure to consult your mbk manager online.

Commodities.

Commodities are basic goods used as inputs in the economy. As such, basic goods can potentially be good investments. Some commodities, such as precious metals, are used as a store of value and a hedge against inflation.

Commodity ETFs give ordinary investors easy and inexpensive access to various commodities markets.

It is important to assess your tolerance for risk before deciding how to invest in stocks and if you need help with your investments, be sure to consult your mbk manager online.

OTC Trading

Indicies.

Indices are a measurement of the price performance of a group of shares from an exchange. Trading indices enables you to get exposure to an entire economy or sector at once, while only having to open a single position.

It is important to assess your tolerance for risk before deciding how to invest in stocks and if you need help with your investments, be sure to consult your mbk manager online.

Precious Metals.

Precious metals are metals that are rare and have a high economic value, due to various factors, including their scarcity, use in industrial processes, and role throughout history as a store of value. The most popular precious metals with investors are gold, platinum, and silver.

Precious metals are rare commodities that have long been valued by investors. They were historically used as the basis for money, but today are traded mainly as a portfolio diversifier and hedge against inflation.

It is important to assess your tolerance for risk before deciding how to invest in stocks and if you need help with your investments, be sure to consult your mbk manager online.

Forex market

NFP(Non-Farm Payroll)

NFP is the abbreviation for Non-farm payrolls. It forms part of the monthly US employment report from the U.S. Bureau of Labor Statistics. Non-farm payrolls (NFP) are an important economic indicator related to employment in the U.S, NFP trading strategies are a good fit for the more advanced trader. That’s because the NFP report brings with it increased volatility. We also see a significant reduction in liquidity in the lead-up, which makes spreads wider and risk higher. The Nonfarm Payrolls (NFP) are among the biggest market movers in the Forex markets, together with central bank events or interest rate decisions. It is important to assess your tolerance for risk before investing.

trading solution

Energy.

Energy trading involves products like crude oil, electricity, natural gas and wind power. Since these commodities often fluctuate abruptly they can be attractive to speculators.

Traders can buy and sell energy shares in the stock market through share trading, which involves purchasing the stock outright and taking partial ownership of the underlying asset, or they can spread bet and trade CFDs on the price movements of energy share prices.

It is important to assess your tolerance for risk before deciding how to invest in stocks and if you need help with your investments, be sure to consult your mbk manager online.

Company Shares

Shares

Shares. A company’s capital is divided into small equal units of a finite number. Each unit is known as a share. In simple terms, a share is a percentage of ownership in a company or a financial asset. Investors who hold shares of any company are known as shareholders.

Share trading is sometimes referred to as Equity trading, as the owner of Shares has direct equity in the company they have chosen to invest in. Share trading means buying and selling the shares of companies listed on the stock exchange with an aim to make profit

It is important to assess your tolerance for risk before deciding how to invest in stocks and if you need help with your investments, be sure to consult your mbk manager online.

Real Estate.

Real estate investment is a financial strategy that uses the management, ownership, purchase, rental, and/or sale of property for profit. There are several ways to invest in real estate, but they all rely on similar economic factors to earn profit. The first is that the property must increase in value.

The benefits of investing in real estate include passive income, stable cash flow, tax advantages, diversification, and leverage. Real estate investment trusts (REITs) offer a way to invest in real estate without having to own, operate, or finance properties.

It is important to assess your tolerance for risk before deciding how to invest in stocks and if you need help with your investments, be sure to consult your mbk manager online.

- 7 Days free trial

- No Credit Card